GP Investment Opportunities

Early-Stage Participation in Value Creation

Invest early. Capture GP-style upside. Maintain LP protections.

GIS offers early-stage investment opportunities for accredited investors who want to participate alongside the property owner during the formation and pre-development phase of a real estate project.

Although we refer to this as the “GP” opportunity, investors do not become General Partners. They participate as limited partners with limited liability, but receive GP-style economics because they enter at the earliest stage of value creation.

This structure aligns GIS, the landowner, and early investors around performance and long-term upside.

Why We Call This the “GP” Opportunity

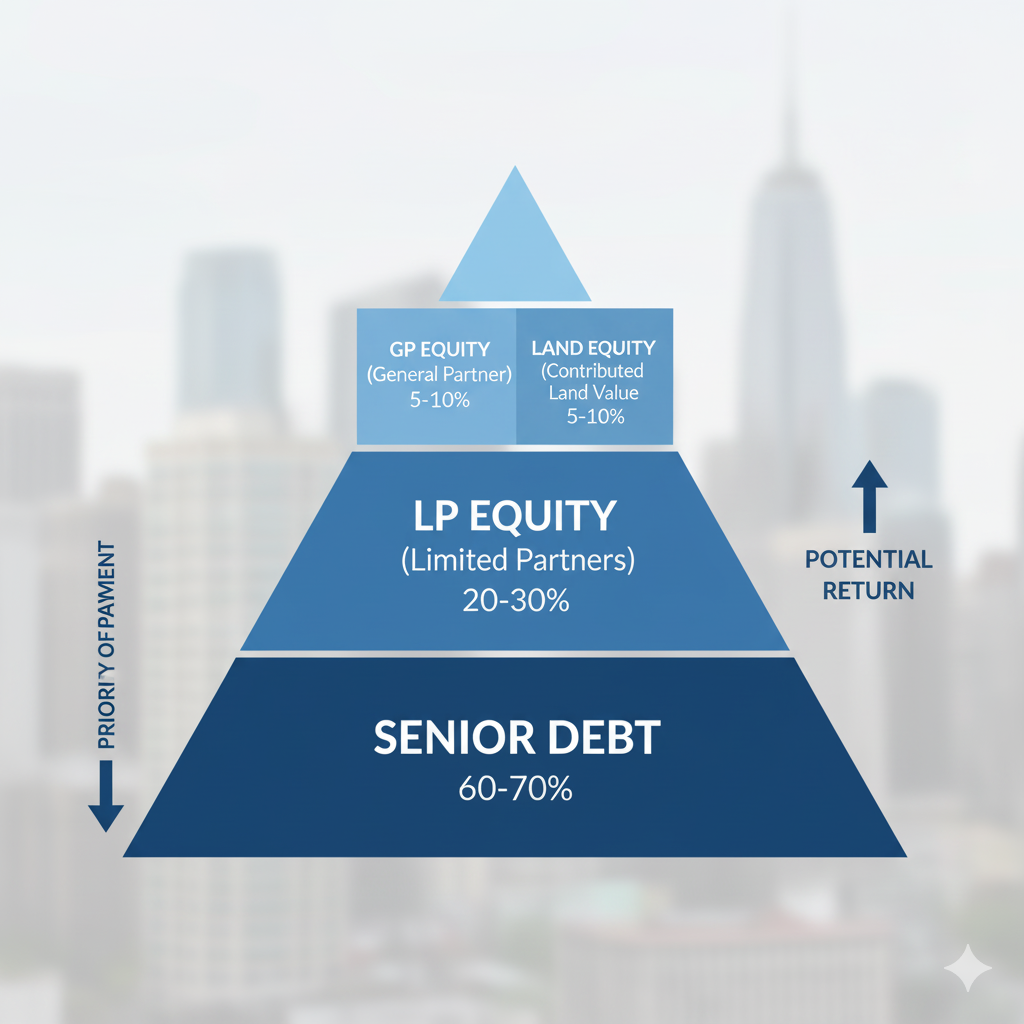

In development finance, the earliest capital — used for feasibility, pre-development, legal structuring, and early design — is commonly referred to as the GP capital stack. The term reflects the industry convention and economic position, not the investor’s legal role.

- are not taking GP liability

- are not signing on loans

- are not assuming personal obligations

They are “limited partners” who receive access to the promote because they join before entitlements, design, and major value creation steps occur.

The GP label simply distinguishes this early-stage opportunity from later-stage traditional LP investments that fund construction or stabilization.

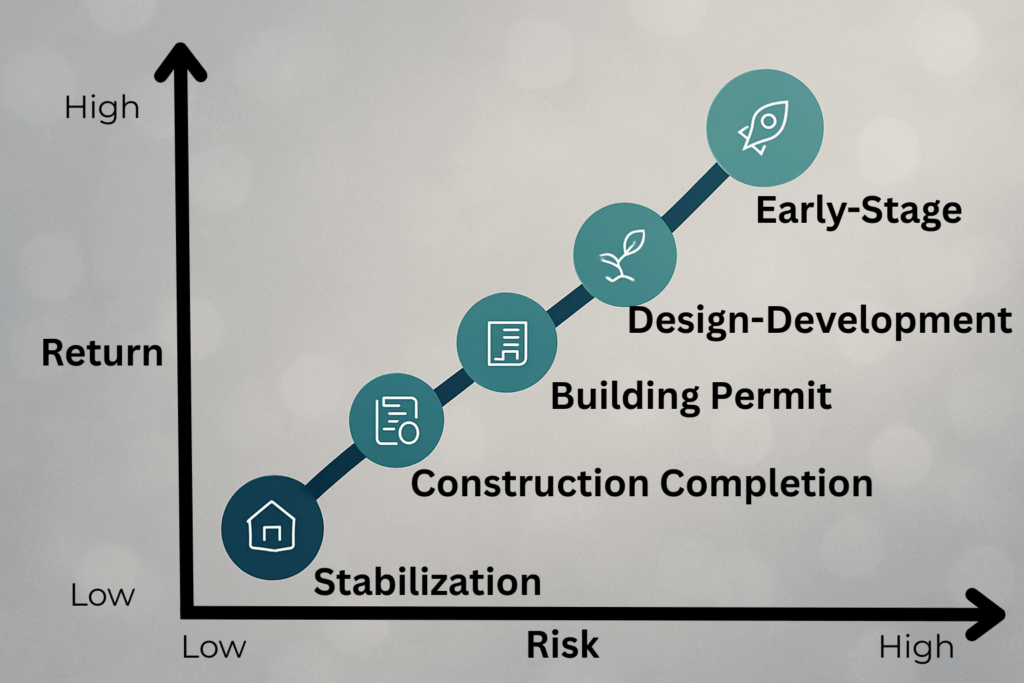

Why Early-Stage Participation Offers Higher Potential Returns

Entering at the earliest stage functions similarly to investing in an early-stage startup:

▲The risk is higher.

▲▲The upside is significantly greater.

- Value creation comes from entitlements, design, approvals, and project structuring — not from stabilized cash flow.

- There is usually no lender debt at this point, so there is no lender pressure or default risk.

If the project succeeds through entitlements and pre-development, investor returns often benefit disproportionately from the uplift in project value.

How Economic Participation Works

Early-stage investors participate economically alongside:

- The property owner

- Other GP-stage investors (if any)

Key Features:

- Limited partner legal status

- Limited liability (no personal obligations, no guarantees, no recourse)

- Participation in promote/carry

- Preferred return available only on select opportunities

Pari Passu Ownership Allocation

Ownership is transparent and tied directly to contributed value relative to current land value.

Example Formula Applied:

$400k Investor Capital

$4M Current Land Value

Approx. Ownership

10%

What GP-Stage Capital Funds

Early-stage investment typically covers the critical steps needed to unlock the project’s institutional value. This stage typically does not involve lender debt.

Phase 1: Planning

- Feasibility and underwriting

- Capital structuring and project planning

- Legal entity formation

Phase 2: Execution

- Engineering, surveying, and initial design

- Pre-development work

- Entitlement strategy and city interaction

Phase 3: Readiness

- Preparation for incoming LP and senior debt

- No investor is responsible for loan guarantees or project obligations.

Who This Is For

High-upside exposure to ground-up development

Understand early-stage development risk

Prefer performance-driven returns over fixed yields

Want access to promote economics without taking GP liability

Typical participants include:

- High-net-worth individuals

- Family offices

- Experienced entrepreneurs and operators

- Investors seeking asymmetric return potential

Our Role in the GP Stage

GIS defers its profit into equity, aligning our incentives with our partners.

- Deal sourcing and feasibility

- Budgeting and project modeling

- Capital stack design and early-stage execution

- Full pre-construction coordination

- Construction oversight (once the project advances)

- Exit strategy, leasing, sales, and disposition

- Investor reporting

Next Steps

If you’re interested in reviewing GP-stage opportunities, request our current project pipeline.

Legal & Compliance

This page is for informational purposes only and does not constitute an offer to sell or a solicitation to buy securities.

All investments are offered solely to accredited investors and only after review of all legal materials, including:

- Private Placement Memorandum (PPM)

- Operating Agreement

- Subscription Agreement

- Full risk disclosures

No funds are accepted until all documents have been reviewed and executed. Project terms, returns, and risks vary by deal. Past performance is not indicative of future results.