LP Investment Opportunities

Passive Participation in Fully Underwritten Development Projects

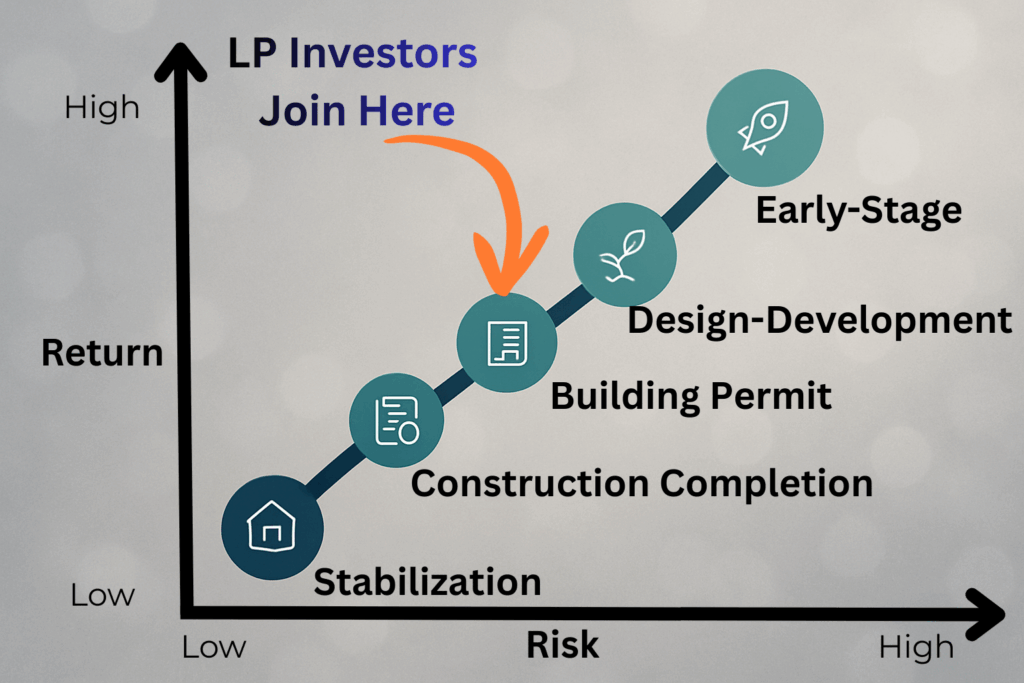

Passive investing in development projects after major early-stage risks have been addressed.

LP investors participate on the LP side of the capital stack, which is separate and distinct from the early-stage “GP-side” capital we raise for pre-development. LP investors do not participate in GP promote structures.

Instead, LP investors enter the project at a later stage — when feasibility, early design, entitlement risk, and project structuring have already been completed. This allows LP investors to access development returns with **clearer timelines, defined budgets, and a more stabilized risk profile.

LPs are fully passive, assume limited liability only, and do not sign on loans or participate in decision-making.

How LP Capital Differs From GP-Stage Capital

GP-side Capital (Early Stage)

Early-stage co-sponsorship for feasibility, design, and entitlement funding.

- Economics: GP-Aligned (Shares in promote/carry).

- Timing/Risk: Invests before entitlements and major de-risking steps (Higher Risk).

- Focus: Value creation comes from legal structuring and approvals ("Startup" exposure).

- Liability: Legally LP (Limited Liability); No debt typically involved at this phase.

LP-side Capital (Traditional)

Passive equity investment after key pre-development risks are mitigated.

- Economics: Traditional LP (Pref + Profit, No Promote).

- Timing/Risk: Invests after permitting and major risk removal.

- Focus: Funds defined project completion, construction, and lease-up equity.

- Liability: Fully Passive Limited Partner; Funds Construction Equity.

Why LP Investors Choose GIS

Risk Mitigation Checklist

LP investors are joining a project that is no longer in the uncertain formation stage.

By the time LP capital is called:

- Building permits are issued or ready to be issued

- The senior lender is identified and term sheets are in place

- The design is 100% complete

- A GMP (Guaranteed Maximum Price) contract has been negotiated

- The construction schedule is established

- The development team, property manager, and broker are all in place

- The full project budget is locked and vetted

Who This Is For

High-upside exposure to ground-up development

Understand early-stage development risk

Prefer performance-driven returns over fixed yields

Want access to promote economics without taking GP liability

Typical participants include:

- High-net-worth individuals

- Family offices

- Experienced entrepreneurs and operators

- Investors seeking asymmetric return potential

How LP Economics Work

- Limited partner legal status

- Limited liability (no personal obligations, no guarantees, no recourse)

- Preferred return (depending on the project)

- Profit participation over the preferred return

- Quarterly reporting

- Passive involvement with no decision-making responsibility

LP investors do not share GP promote and are not part of the GP economics layer.

What LP Capital Typically Funds

LP investors fund the remaining equity required to close the senior construction loan. This capital is raised only after the project is fully structured and ready to enter the construction phase.

LP capital does not fund feasibility, entitlement, or early-stage work.

It funds the equity portion of a construction-ready project, when major risks have already been addressed.

Ideal LP Investor Profile

You are a good fit for LP opportunities if you:

- Passive Exposure

Want passive exposure to development.

- Mitigated Risk

Prefer joining after early-stage risk is mitigated.

- Budget Clarity

Want clarity around budget, design progress, and schedule.

- Experienced Developer

Value experienced development management and disciplined execution.

- Diversification

Are seeking diversification into development deals.

- Accredited Only

Are an accredited investor seeking passive involvement.

LP investors commonly include:

High-net-worth individuals, family offices, wealth advisors, fund of funds managers, and accredited investors seeking passive, professionally managed exposure to development.

Project Types Suitable for LP Investment

- Market-rate multifamily

- Workforce housing

- Townhome communities

- Mixed-use infill

- Subdivisions

- Built-to-Rent Communities

- Senior living communities

- Manufactured home parks

Reporting and Visibility

LPs receive full visibility into the project’s performance and progress through:

Construction progress updates

Budget vs. actual reporting. Plust Cost to Complete

Financial & Distribution statements

Sales or refinance summaries

Next Steps

If you’re an accredited investor interested in passive LP opportunities:

Legal & Compliance

This page is for informational purposes only and does not constitute an offer to sell or a solicitation to buy securities.

All investments are offered solely to accredited investors and only after review of all legal materials, including:

- Private Placement Memorandum (PPM)

- Operating Agreement

- Subscription Agreement

- Full risk disclosures

No funds are accepted until all documents have been reviewed and executed. Project terms, returns, and risks vary by deal. Past performance is not indicative of future results.