Alignment through Equity: How Deferred Profit Ensures We Are Incentivized by Your Success

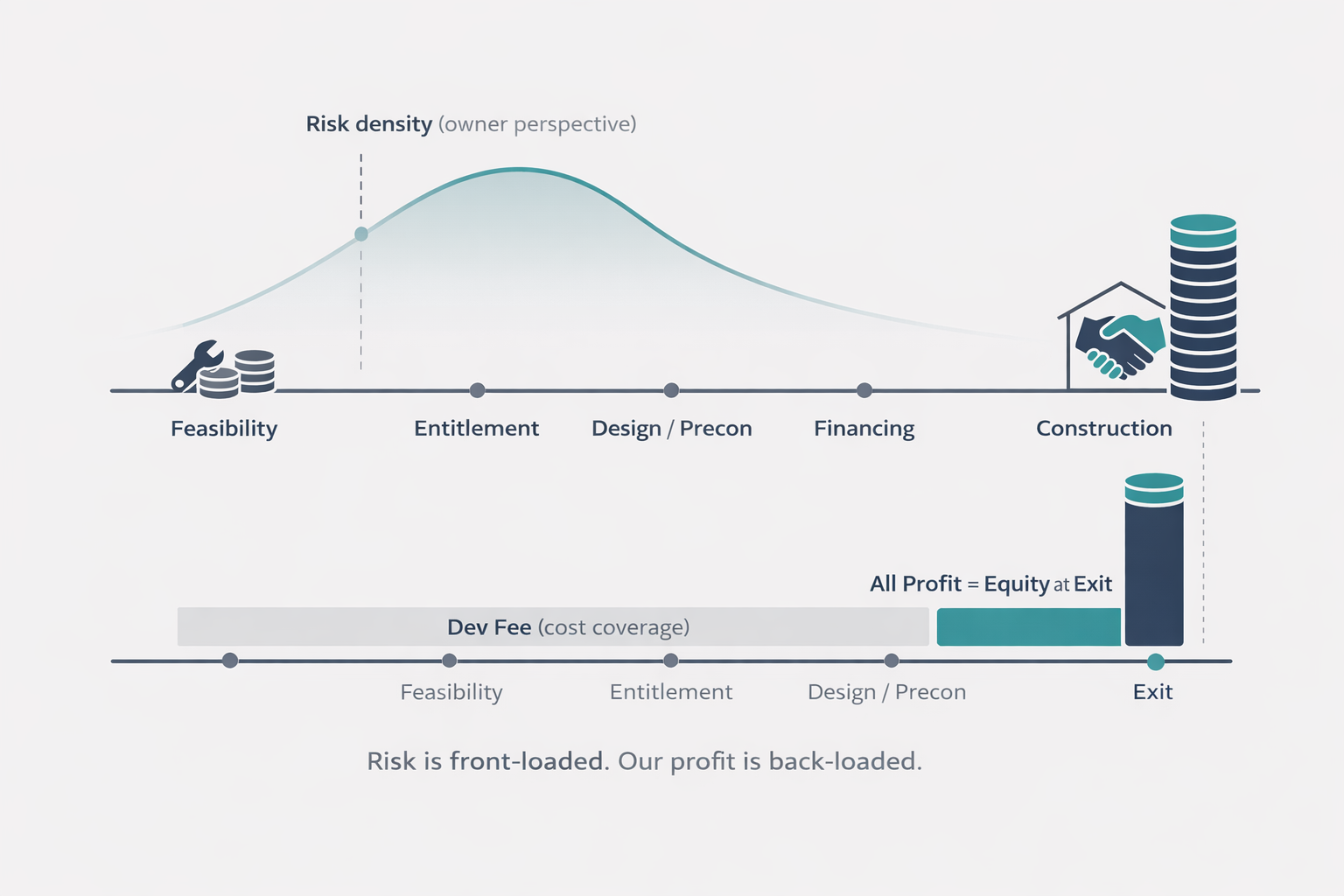

Deferred profit is simple: we earn upside only if the project succeeds, because all of our profit is deferred into equity that pays out at sale, refinance, or stabilization.

What it is not is “we work for free until the end.”

What “deferred profit” means in practice

On most projects, we structure compensation in two distinct layers:

-

A development fee that is budgeted into the project

Paid over time as work is performed. This fee is typically sized to cover operating costs—staff, systems, underwriting, coordination, and the day-to-day execution work required to move a project from raw land to a buildable, financeable plan. We do not program profit into this fee.

-

Profit that is fully deferred into equity

Paid only if the project performs. We do not take profit upfront or during the duration of the project. Instead, all profit is deferred and converted into equity economics that only have value if the project succeeds.

That split is the point: cost coverage now, outcome-based profit later.

Quick clarification: we are not “getting paid at the end”

This is a common misconception, and it creates a weird dynamic where people try to avoid paying anything until the project is finished. That isn’t realistic, and it isn’t healthy for the project.

If someone expects the operator to wait for all compensation until the finish line, what they’re really asking for is the operator to bankroll execution risk. In the real world, that either produces under-resourcing, corner-cutting, or compensation that reappears somewhere else in the deal in less transparent ways.

Here’s another way to think about it: what if we are unable to continue working on your project midway—for any reason? You would need to replace us, and you would almost certainly have to pay for that work. If you never budgeted for development management in the first place, your project could be in deep trouble at exactly the wrong moment.

So to be blunt: the development fee keeps the machine running. The deferred equity is what keeps us obsessed with the outcome.

Why this structure changes how we operate

We don’t believe in selling time. Our service is the product: feasibility discipline, entitlement strategy, team orchestration, preconstruction reality checks, capital packaging, and the boring-but-critical cadence of decisions that keeps a project moving.

If the goal was to maximize guaranteed pay, we’d all go get jobs elsewhere. The reason this model exists is because we want compensation tied to what actually matters: a project that survives underwriting, survives entitlement, survives construction, and exits cleanly. And we believe this model lets us make a real dent in the housing shortage nationwide—not just make an extra buck.

Where projects quietly lose money

Most landowners don’t lose money because they chose the wrong architect. They lose money because early decisions were made with optimism instead of probability, and because the people making those decisions weren’t financially exposed to the downstream consequences.

That typically shows up as:

- Design advancing before contractor pricing reality is integrated.

- Entitlement strategies chosen because they “sound best,” not because they’re most likely to get approved.

- Schedules built to impress, not to survive review cycles.

- Capital conversations happening too late or too early.

Deferred profit doesn’t magically remove risk—but it does make us behave like risk is real, because it is.

Key Takeaways

- The development fee covers costs, not profit.

- All profit is deferred into equity and only realized if the project succeeds.

- Reduces incentive to overscope or "sell" aggressive schedules.

- A 5–10% budget miss can erase most of the owner’s margin.

- A 3–6 month slip has measurable carry impacts.

- If you get “free” feasibility, the value is often exactly what you paid for it.

“Free feasibility” is usually a trap

Early-stage diligence is where most value is created (or destroyed). When feasibility is treated as a giveaway, it tends to be shallow. To reuse a phrase that’s annoyingly true: when you get free anything, the value is often exactly what you paid for it.

A practical framework for landowners

If the operator can’t staff the work properly, the project will drift.

If the operator’s economics are mostly guaranteed, their decision-making will reflect that.

If not, you’re not doing feasibility—you’re producing drawings.

Not too late when boxed in, and not too early before assumptions are durable.

Summary

Deferred profit is not a promise and it’s not “we’ll get paid at the end.” It’s a transparent split:

- Development fee: keeps execution properly resourced and accountable.

- All profit deferred into equity: puts our upside in the same outcome the owner cares about.

That’s how we stay disciplined, honest about risk, and financially motivated to produce a project that actually exits—and produces more housing where it’s needed.