Bankable Roadmaps:

The Feasibility Study That Secures Senior Debt and Institutional Capital

A Bankable Roadmap is a 30–120 page professional feasibility study built specifically to secure senior debt and institutional capital by translating a property’s development potential into an execution plan lenders and investors can underwrite.

Most feasibility work answers, “Could we do something here?”

A Bankable Roadmap answers, “Can we finance, permit, and build this—on a timeline and budget that survives underwriting?”

Key Takeaways

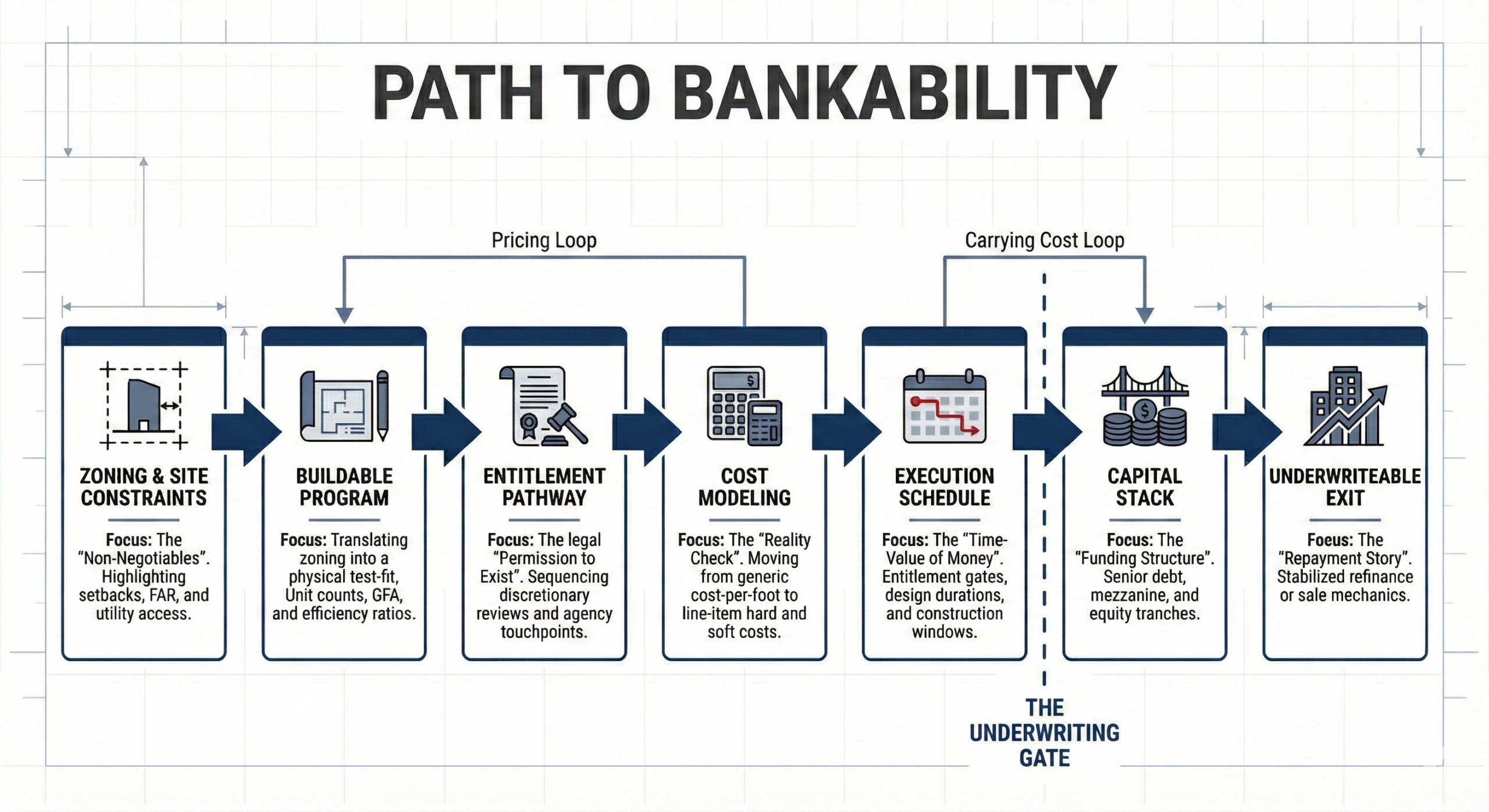

- A Bankable Roadmap connects zoning → buildable scope → cost → schedule → capital stack → exit in one consistent package.

- If assumptions can't support loan sizing (LTV/LTC, DSCR), you won't get a term sheet.

- Includes a predevelopment budget covering legal, third-party reports, and the capital raise process itself.

- Capital diligence is driven by risk: lenders want to see skin in the game and a relevant track record.

- Most avoidable losses happen early; disconnects between design and pricing can burn $100,000+ in wasted fees.

What is a Bankable Roadmap?

A Bankable Roadmap is a feasibility study used as an execution plan—built to withstand lender and institutional review—so a landowner can pursue development with a clear path to approvals, pricing, funding, and repayment.

It’s the bridge between an idea and a capital-ready project.

What Makes a Feasibility Study “Bankable”?

A feasibility study becomes bankable when it produces these core pillars that underwriting can actually use:

Unit mix, density/FAR, parking, and access—defined tightly enough that it can be priced and permitted.

Sequence, dependencies, agency touchpoints, and a timeline that reflects real-world agency speeds.

Budgets grounded in scope reality—not generic guesses—structured to tighten from ROM toward GMP.

An execution schedule tied to entitlement gates, design deliverables, and procurement constraints.

What gets funded now vs. later, senior debt conditions, and realistic equity requirements at each stage.

A repayment story supported by market comps: sellout, stabilized refi, or phased takeout.

Budgeting for the actual costs to reach a close: legal entity structuring, third-party reports (Geotech, Phase I/II, Appraisal), and lender diligence fees.

What Capital Actually Asks (and Why)

Capital doesn’t start with your renderings. It starts with execution risk.

Expect questions that drill into your commitment and capability:

- What is your skin in the game? Cash invested, land basis, guarantees—anything that signals alignment.

- What is your track record? Relevant examples of similar entitlement paths or product types.

- What are the failure modes? Anticipating risks with documentation, not "vibes."

Attributes of a Bankable Roadmap

- Underwriting Logic: It’s a consistency test. Do the assumptions match the market? Does the budget match the scope?

- Early Pricing: It ties design to pricing before drawings harden, preventing expensive redraw cycles.

- Decision Gates: Identifies go/no-go moments to protect the owner from "drifting" into unviable commitments.

- Risk Mitigations: Documents every risk (entitlement, cost, market) and assigns a response plan.

Bankable Roadmap vs. Typical Feasibility

Typical Feasibility

- Market overview with generic comps

- Rough pro forma on soft assumptions

- Concept plan not tied to pricing

- Entitlement "should be fine"

Bankable Roadmap

- Underwriting-ready model structure

- Entitlement mapped to agency sequence

- Budget tied to GC feedback

- Capital raise costs & timeline included

Common Mistakes (and Why They Get Expensive)

Mistake 1: Treating feasibility as optional. Skipping this step shifts costs into redesign and delays later when time is most expensive.

Mistake 2: Designing ahead of pricing. If pricing comes after design hardens, you enter a cycle of redraw → reprice → reset.

Mistake 3: Confusing “interest” with “commitment.” Documentation quality is what turns a lender's curiosity into a term sheet.

Summary

A Bankable Roadmap is the feasibility study that turns a site into an underwriteable project. It connects zoning reality, pricing, and capital readiness into one coherent plan.

If you want senior debt and institutional capital, the goal isn’t to “look credible.” The goal is to produce a document that makes the project financeable on paper before it becomes expensive in the field.